VB Master User Guide

1. OVERVIEW

VBMaster is a software tool designed to address the challenges associated with manual record-keeping for Village Banking Groups by providing an automated online record management platform.

Unlike traditional methods, VBMaster focuses on data input and management, ensuring a secure, efficient and transparent record management solution for your Village Banking Group.

2. INSTALLATION

VBMaster is an online program which can be accessed anywhere using the link:https://www.villagebanking.co.zm. A mobile app for the VBMaster will be available soon.

3. USER REGISTRATION/LOGIN

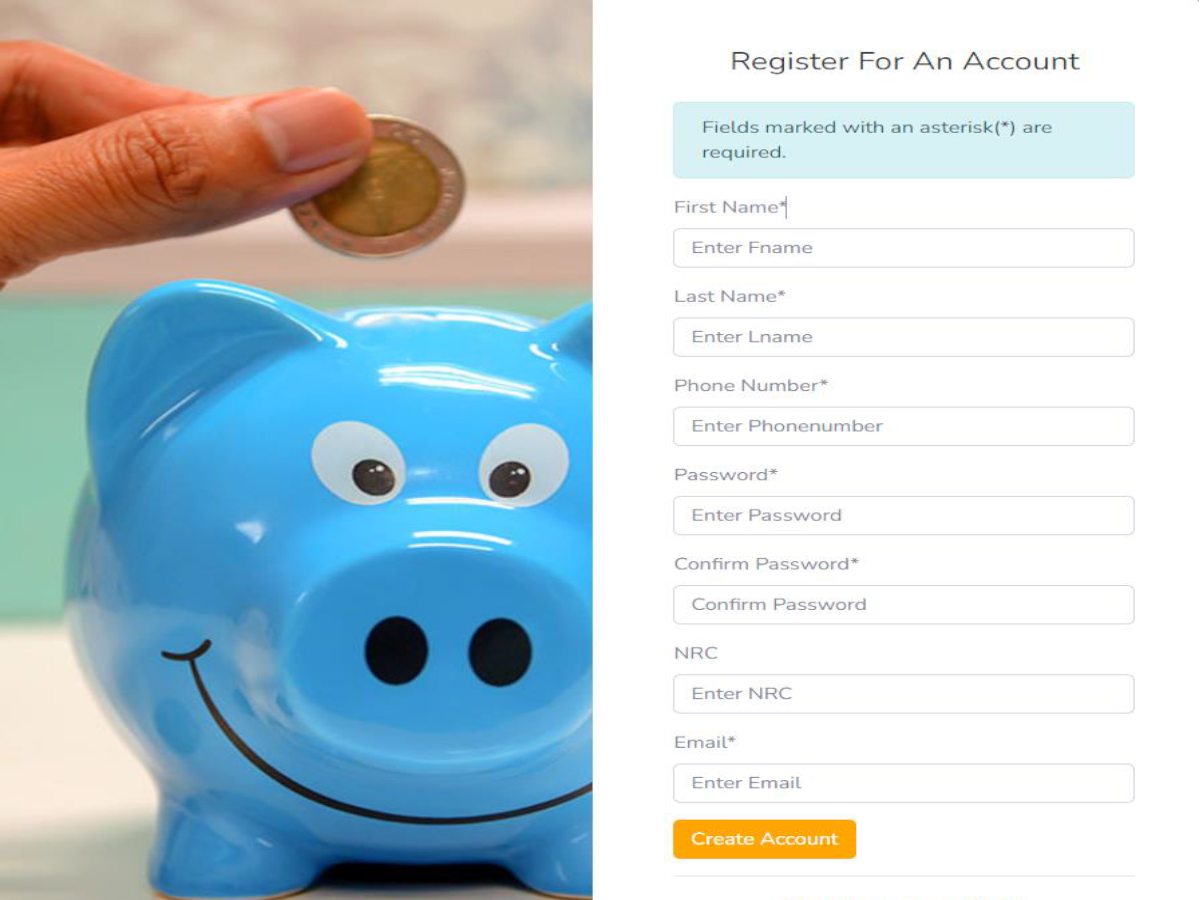

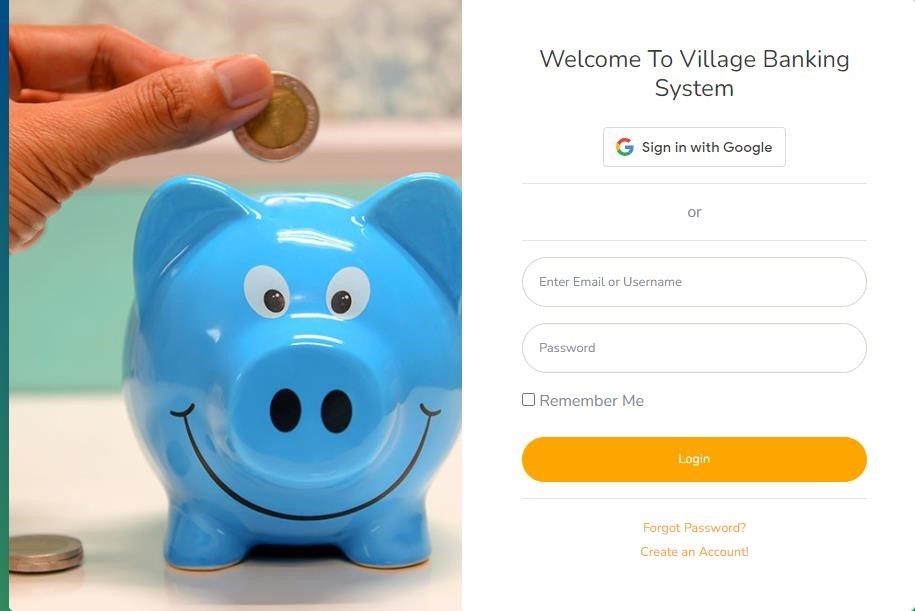

Registration is prerequisite and therefore you must register as a user and create or join a Village Banking Group before using VBMaster.

To sign up, you must provide your full name, email address, phone number, and proposed password. Alternatively, you can register using your Google account. The login details should be the email address and password provided.

4. DASHBOARD

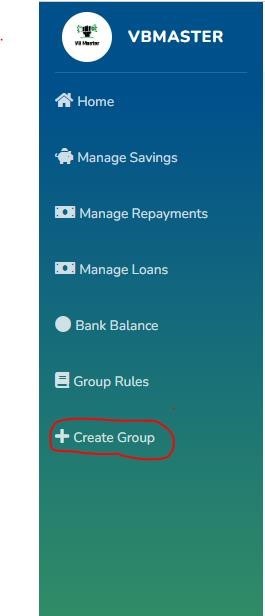

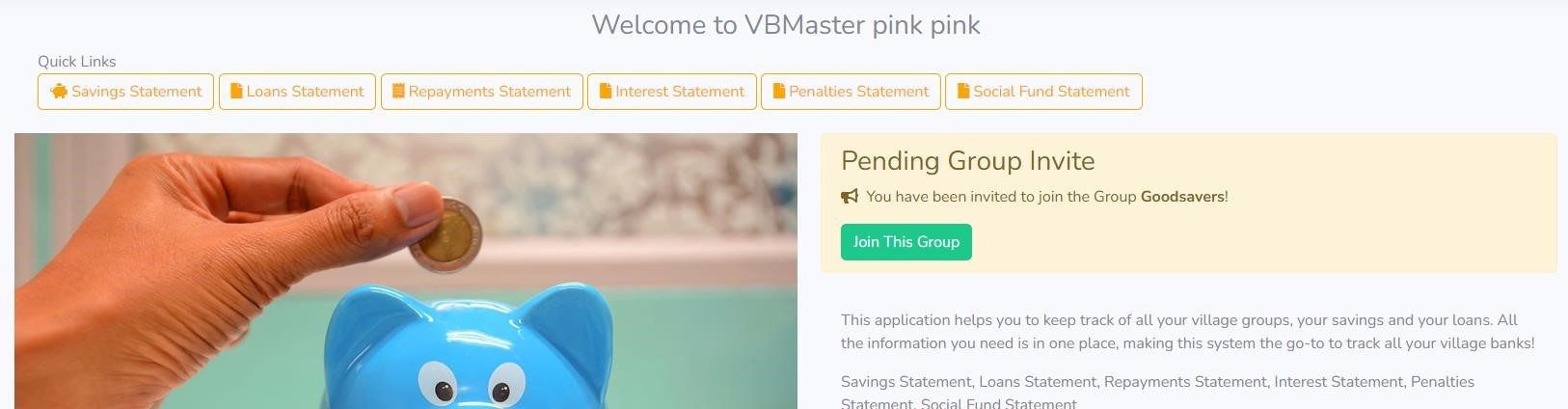

Once you log in, the dashboard below provides you with an interface to use VBMaster. If you have not been invited to join an existing Village Banking Group on VBMaster, you will need to create a new Village Banking Group.

5. STEP 1- CREATING A GROUP

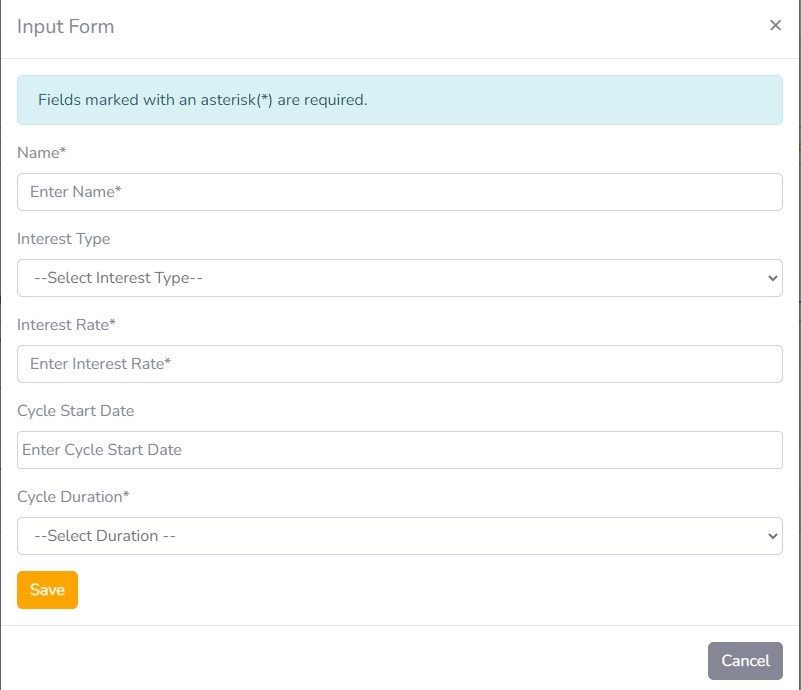

Click CREATE GROUP to start the process of creating a Village Banking Group. When you click CREATE GROUP, the program will prompt you to enter key details explained below.

5.1.1 Name of group - This is the name of your Village Banking Group for ease of accessibility or identification should you or any of your members belong to more than one Village Banking Group. It can be any name provided it is not offensive and the name is at the discretion of the user.

5.1.2 Interest Type – Using a drop down, select the applicable Interest Type: Simple Interest or Compound Interest.

- For simple interest, the interest is only charged once. For instance, if you get a Loan of 5000 and the agreed interest rate is 10%. The interest payable on your loan is 500 (10% of 5,000) and it is only charged once.

- For compound interest, the interest will be charged every month on any loan balance which is due. For instance, if you get a loan of 5,000 and the agreed interest rate is 10%.

5.1.3 Interest Rate : insert the Interest Rate which will be charged on all the loans for your Village Banking Group

5.1.4 Cycle Start Date: insert the start date of your Village Banking Cycle.

5.1.5 Cycle Duration :using a drop down, select the duration of your Village Banking Cycle: 3 months, 6 months, 1 year and 1 year 6 months.

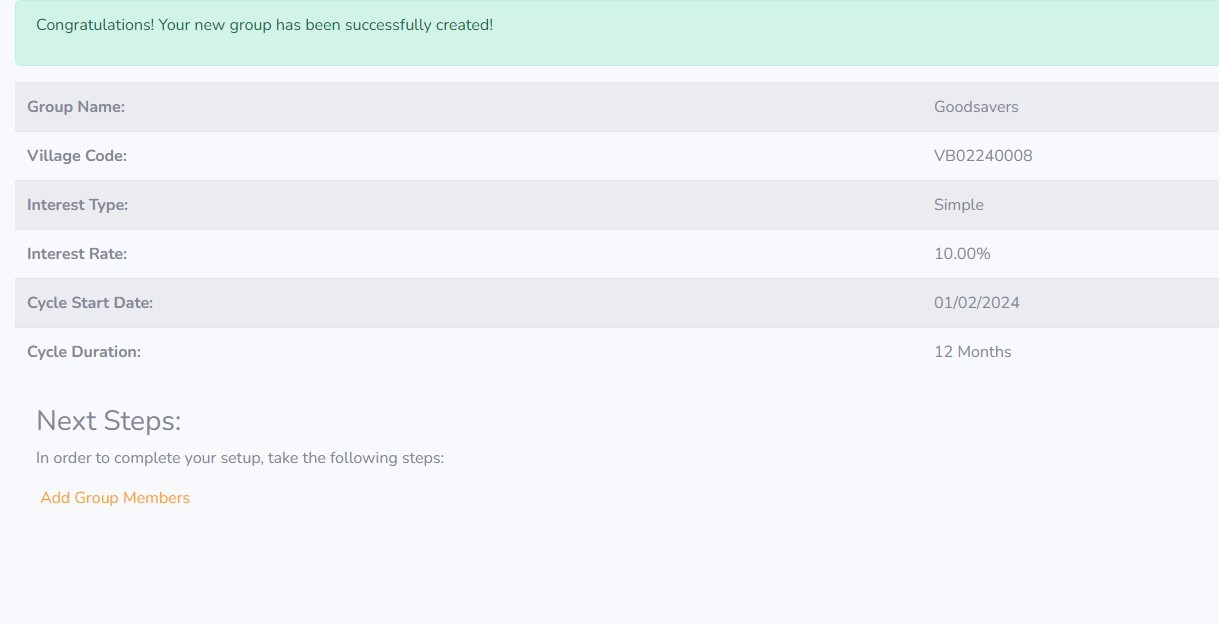

Click SAVE to save the information and create your Village Banking Group. You will receive a congratulatory message which also summarizes your Village Banking Group settings. The message will also advise the next steps which you need to take:

NON-MANDATORY SETTINGS

VBMaster is a flexible platform which accommodates the various rules for different Village Banking Groups. Please see other non-mandatory settings below for more information on this.

6. STEP 3 – ADDING MEMBERS

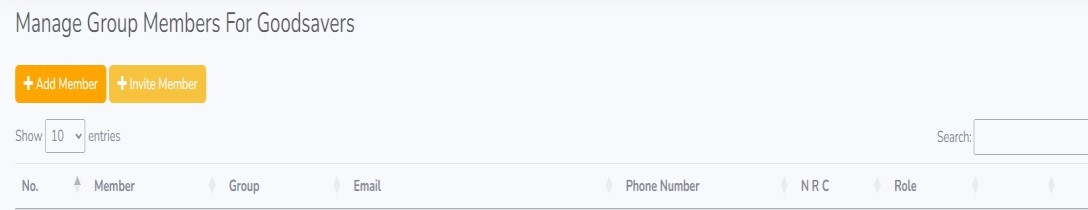

6.1 Once you have created a Group, you will be assigned as an administrator for that Group and the next step is for you to add or invite members/people to your Group. Click “Manage Groups” and if you are admin in more than one Group, select the Group where you intend to add more members:

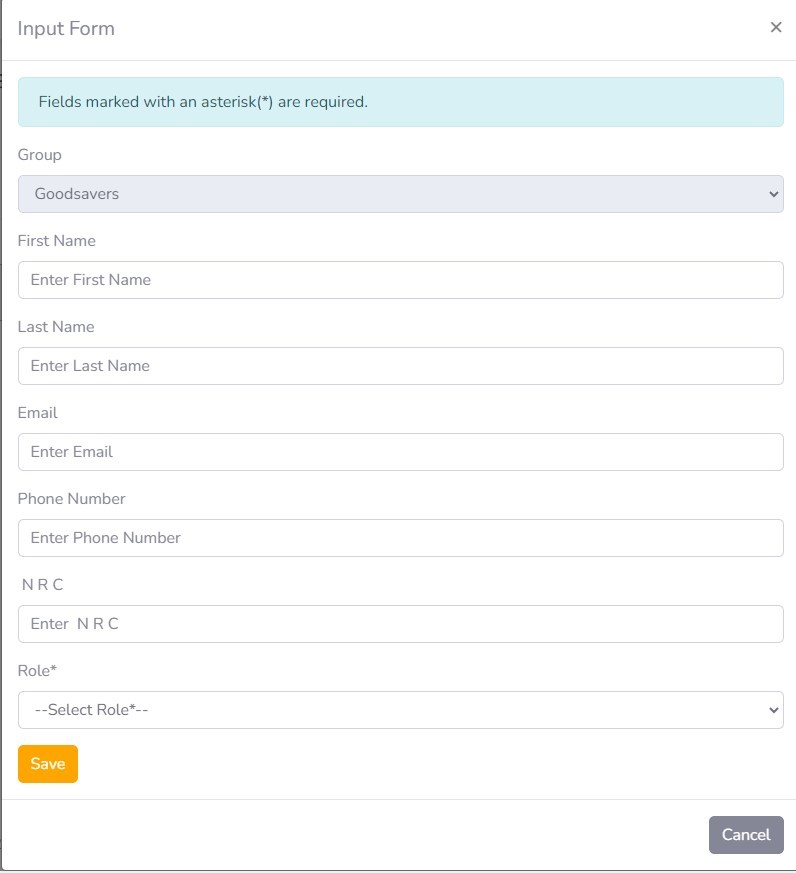

ADD MEMBER

Click ADD MEMBER to add people to your Village Banking Group by providing the following information: full name, email address, mobile number and NRC number. The admin should also assign the role of this member (admin or member).

And click SAVE. Repeat the process for all the other members. There is no limit on the number of members each Group may have.

INVITE MEMBER

Click INVITE MEMBER to invite a person to join your Village Banking Group as a member by providing the following required information: Full Name and valid email address.

And click INVITE. Repeat the process for all the other members.

An email will be sent to the person invited inviting him or her to join your Village Banking Group and provided with login details if they are not registered.

Once a person has been added or invited as a member, they will be able to log in, join the Group by clicking on “Join This Group”.

7. SUBMITTING INFORMATION

SAVING

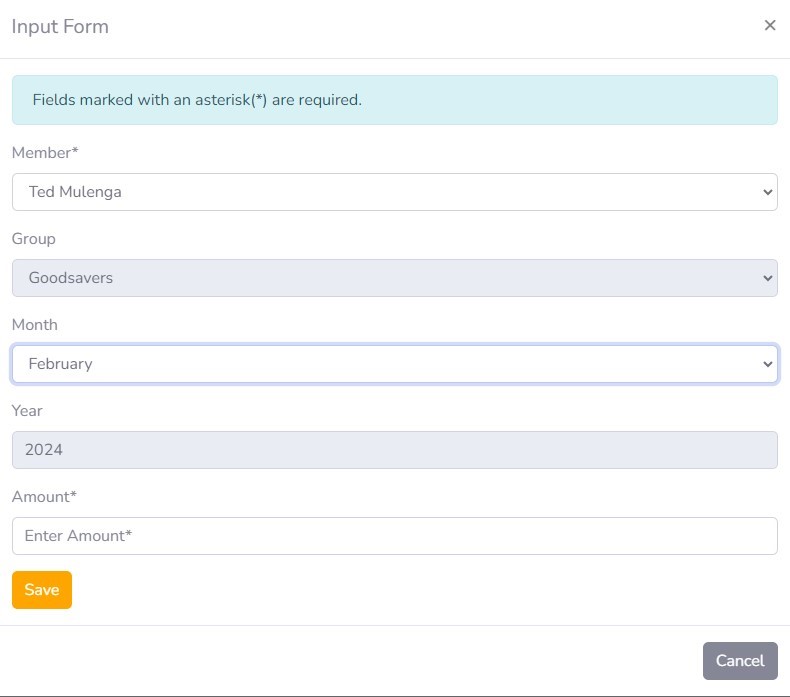

Click Manage Savings and then “Add New’ to add the amount you intend to save for that month by inserting the amount you intend to save and click “SAVE”. Please see below.

For members of the Village Banking Group who do not have their own profiles, an admin can submit the records on behalf of those members. By following the process above and using the drop-down menu under member to select which member the admin wishes to add the information on behalf.

LOAN

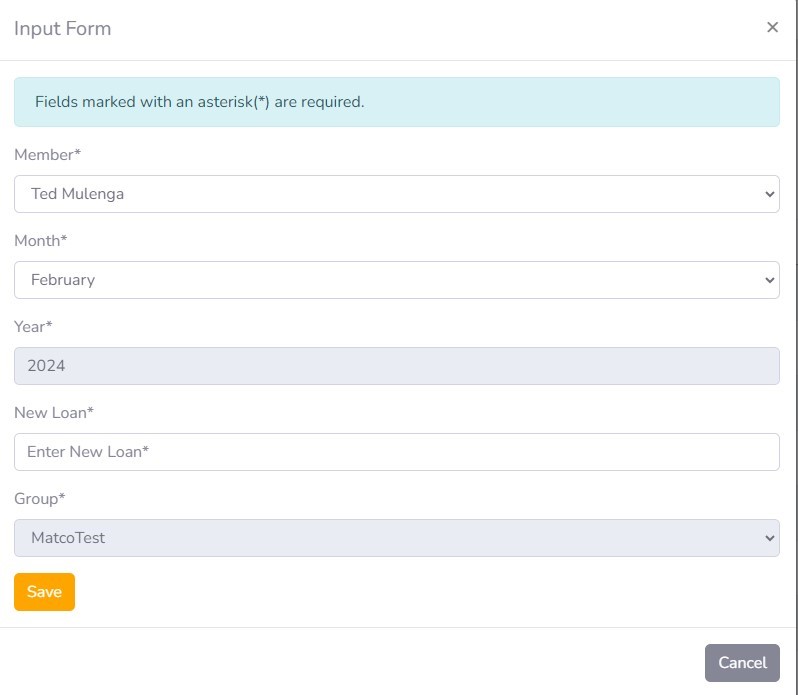

Click Manage Loans and then “Add New’ to add the amount you intend to borrow for that month by inserting the amount you intend to borrow and click “SAVE”. Please see below.

For members of the Village Banking Group who do not have their own profiles, an admin can submit the records on behalf of those members. By following the process above and using the drop down menu under member to select which member the admin wishes to add the information on behalf.

REPAYMENT

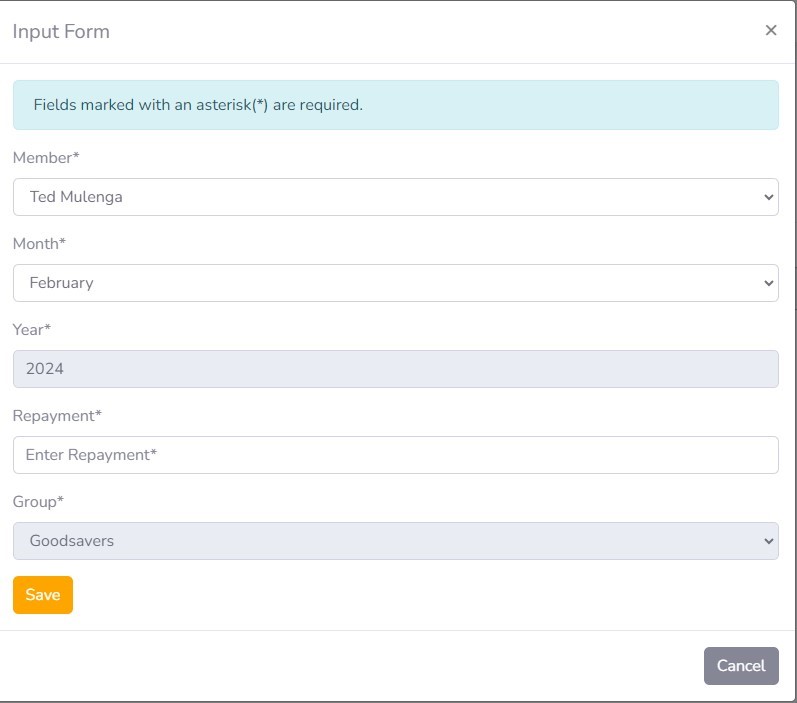

Click Manage Repayments and then “Add New’ to add the amount you intend to repay towards your loan for that month by inserting the amount you intend to borrow and click “SAVE”. Please see below.

For members of the Village Banking Group who do not have their own profiles, an admin can submit the records on behalf of those members. By following the process above and using the drop-down menu under member to select which member the admin wishes to add the information on behalf.

8. ADMIN APPROVALS

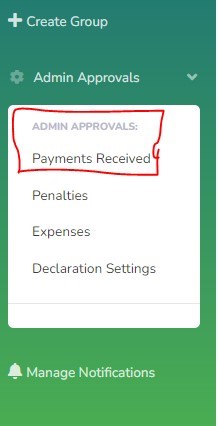

Payments Received • To ensure that the information being submitted, and amounts being sent to the treasurer or Group account are aligned, the admin has final powers to approval all final submissions.

- The Admin can either approval the submission (i.e Savings, Repayment) if the money deposited is the same as the amount which a user has submitted. If there is a difference, the admin can reject and that entry will automatically be deleted and at the same time the user will be notified of the rejection.

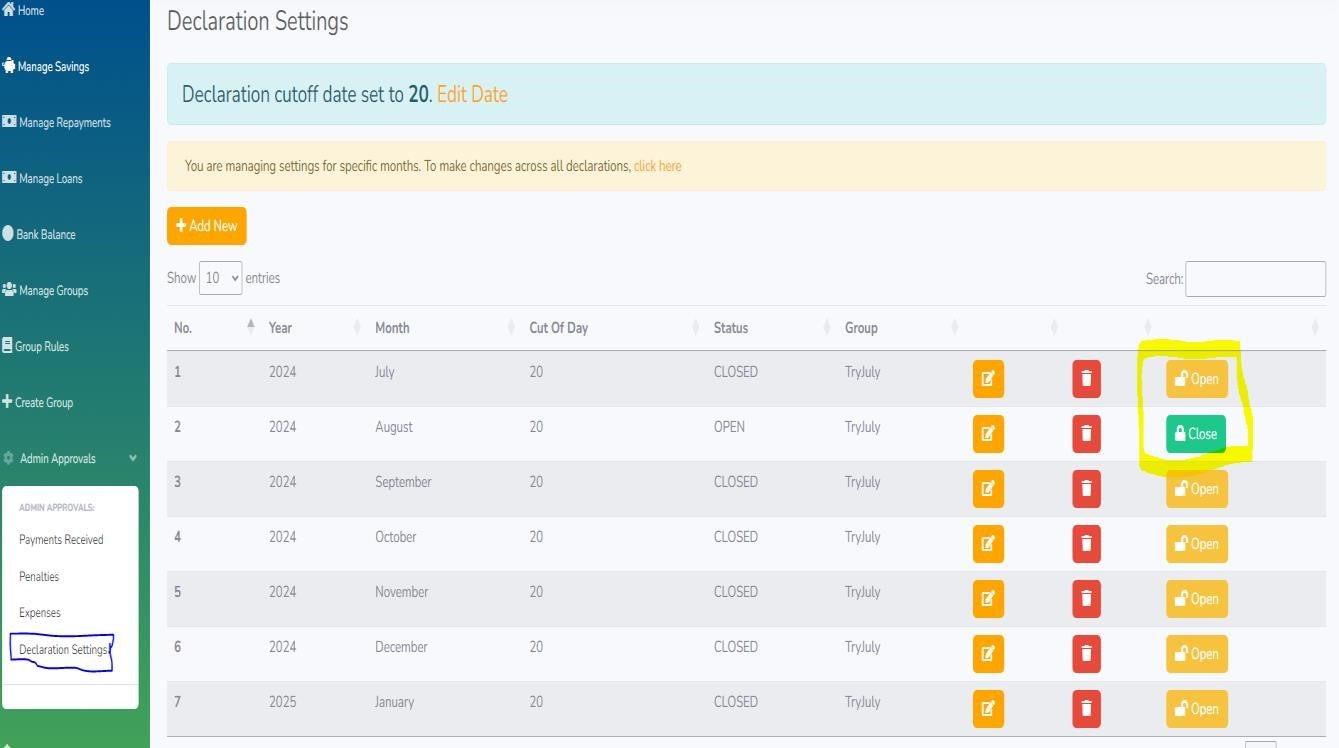

Declaration Setting

The process in 7 above must be repeated for each month until the cycle is completed. However, to avoid a user entering details for a future month or editing records from the previous months, the admin has discretion to open all the months or only that month in which members are required to submit the requisite information. The first month of the cycle is automatically open. The other months must be opened by the admin or a date on which the subsequent month should be open can be set. Please see below.

All information will be submitted for a month which is still closed.

9. STATEMENT

VBMaster updates and generates statement automatically each time new information is submitted by the admin or any member of the Group. To view the available statements, click ‘HOME’ and the click on the statement you want to view.

Interest Earned

The interest which a member earns can be viewed under the Interest Statement.

10. EDIT AND DELETE

Members are permitted to delete or edit the submitted information provided the month is still open and the admin has not closed the month.

11. OTHER FUNCTIONALITIES

- Bank Balance – this shows the funds available for the members to borrow

- Social Fund – if the Group has provisions for members to contribute either a member fee or social fee. This is the functionality which supports that

- Manage Members – details or information of the members may be updated and changed

- Optional Group Rules

- Minimum saving – Group can set the minimum saving amount

- Loan Cap – Group can set a rule which sets the maximum amount a member can get

- Penalties – Group can impose penalties at its discretion and the Group can decide how that penalties should be treated

- Minimum repayment – Group can impose a minimum amount which a member should repay. Only applicable to a Group using simple interest.

VBMaster

VBMaster